394

According to the SEC's order, Merrill Lynch failed to disclose its conflicts of interest when recommending that clients use directed brokerage to pay hard dollar fees, whereby the clients directed their money managers to execute trades through Merrill Lynch. These clients received credit for a portion of the commissions generated by these trades against the hard dollar fee owed for the advisory services provided by Merrill Lynch Consulting Services. Consequently, Merrill Lynch and its investment adviser representatives could and often did receive significantly higher revenue if clients chose to use Merrill Lynch directed brokerage services. The SEC's order finds that Merrill Lynch also faile...

Details

Created

Apr 24th, 2022, 21:00

Blockchain

ETH

Storage

decentralized

Token standart

ERC-721

Metadata

Unlockable content

No

Rarity

Rarity score

N/A

Rarity rank

N/A / 1500

Trait count

0

What is the value?

Price

Sales

Sales (All)

N/A

Avg collection sales (All)

N/A

Difference

N/A

Collectible last sale price

--

Collection avg price (All)

--

Difference

N/A

Collectible last sale price

--

Collection min price (All)

--

Difference

N/A

Successful royalty payments

--

Skipped royalty payments

--

Difference

N/A

Activity history

Processing data. Please, come back later.

Critical Risk

Details

0 sales per last month

Decentralized storage

7.5%

Decentralized storage

Collection tokens1500 tokens

Unique Owners395 / 26.33%

Custom contract

ERC-721

Not editable metadata stored on ipfs or blockchain

0 potential sales

0% missed royalty fee

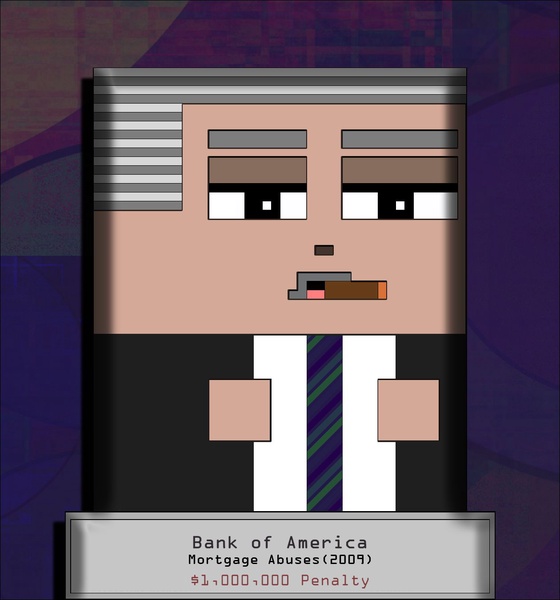

The original collection.

Found 0 similar collections

More from The Banksters

| # | NFT | 7D CHANGE |

|---|

Showing 1-10 out of 1,499

Rows per page

10